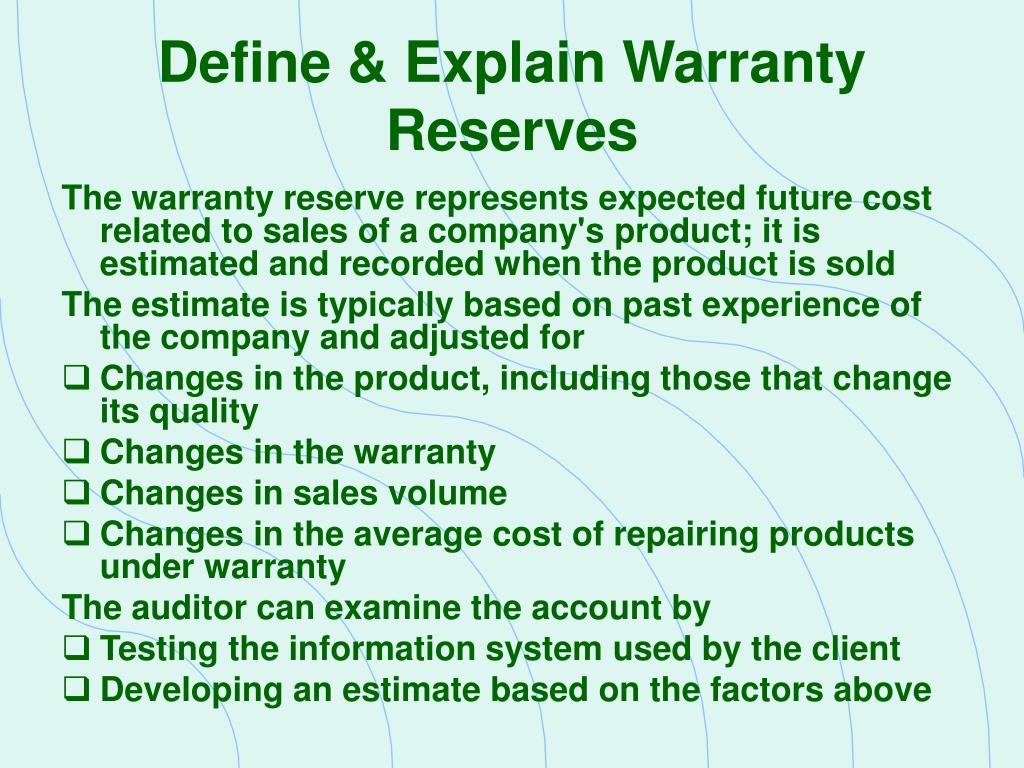

Warranty Reserve Expense . costs incurred to either repair or replace the product are additional costs of providing the initial good or service. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. warranty expense is the cost associated with a defective product repair, replacement, or refund. financial reporting is impacted by warranty reserves as they appear on the income statement under expenses. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. A warranty comes with a warranty period during which the vendor or manufacturer of the good is liable for any defects that may appear during the use of the product.

from www.slideserve.com

A warranty comes with a warranty period during which the vendor or manufacturer of the good is liable for any defects that may appear during the use of the product. warranty expense is the cost associated with a defective product repair, replacement, or refund. financial reporting is impacted by warranty reserves as they appear on the income statement under expenses. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. costs incurred to either repair or replace the product are additional costs of providing the initial good or service. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles.

PPT Chapter 14 PowerPoint Presentation, free download ID953212

Warranty Reserve Expense financial reporting is impacted by warranty reserves as they appear on the income statement under expenses. costs incurred to either repair or replace the product are additional costs of providing the initial good or service. manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. A warranty comes with a warranty period during which the vendor or manufacturer of the good is liable for any defects that may appear during the use of the product. warranty expense is the cost associated with a defective product repair, replacement, or refund. financial reporting is impacted by warranty reserves as they appear on the income statement under expenses.

From www.youtube.com

Accounting for Warranty Expense and Warranty Payable YouTube Warranty Reserve Expense manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. A warranty comes with a warranty period. Warranty Reserve Expense.

From www.slideserve.com

PPT Liabilities Introduction PowerPoint Presentation, free download ID7042561 Warranty Reserve Expense manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. costs incurred to either repair or replace the product are additional costs of providing the initial good or service. if a seller can reasonably. Warranty Reserve Expense.

From www.scribd.com

Chapter 3 Warranty Liabilities PDF Expense Private Law Warranty Reserve Expense costs incurred to either repair or replace the product are additional costs of providing the initial good or service. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. . Warranty Reserve Expense.

From shoereaction11.gitlab.io

Fabulous Provision For Warranty Expense What Is A Financial Statement Warranty Reserve Expense manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. warranty expense is the cost associated with a defective product repair, replacement, or refund. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. to comply with this, companies estimate the future costs. Warranty Reserve Expense.

From slideplayer.com

Chapter 5 Using Financial Statement Information ppt download Warranty Reserve Expense you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. A warranty comes. Warranty Reserve Expense.

From screenpal.com

Warranty expense and liability computations and entries Warranty Reserve Expense costs incurred to either repair or replace the product are additional costs of providing the initial good or service. warranty expense is the cost associated with a defective product repair, replacement, or refund. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. if a seller can reasonably estimate. Warranty Reserve Expense.

From www.youtube.com

Warranty expense, statement and statement of cash flows YouTube Warranty Reserve Expense costs incurred to either repair or replace the product are additional costs of providing the initial good or service. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. financial reporting. Warranty Reserve Expense.

From www.youtube.com

ACG 2021 Chapter 8 Warranty Expense and Warranty Payable Part 3 of 3 YouTube Warranty Reserve Expense if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. warranty expense is the cost associated with a defective product repair, replacement, or refund. costs incurred to either repair or replace the product are additional costs of providing the initial good or service. financial reporting is impacted. Warranty Reserve Expense.

From www.slideserve.com

PPT Chapter 14 PowerPoint Presentation, free download ID953212 Warranty Reserve Expense to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. A warranty comes. Warranty Reserve Expense.

From www.superfastcpa.com

What is Warranty Expense? Warranty Reserve Expense financial reporting is impacted by warranty reserves as they appear on the income statement under expenses. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. costs incurred to either repair or replace the product are additional costs of providing the initial good or service. if a seller can. Warranty Reserve Expense.

From www.slideshare.net

Expense Warranty Approach Accounting Warranty Reserve Expense you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. costs incurred to either repair or replace the product are additional costs of providing the initial good or service. . Warranty Reserve Expense.

From involvementwedding3.pythonanywhere.com

Best Warranty Liabilities On Balance Sheet And Statement Example Warranty Reserve Expense you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. financial reporting. Warranty Reserve Expense.

From corporatefinanceinstitute.com

Warranty Expense Overview, Recognition, How To Calculate Warranty Reserve Expense warranty expense is the cost associated with a defective product repair, replacement, or refund. financial reporting is impacted by warranty reserves as they appear on the income statement under expenses. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. if a seller can reasonably estimate the amount of. Warranty Reserve Expense.

From warrantymanaged.com

Rising US Automotive Warranty Expenses Solutions for OEMs Warranty Reserve Expense if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. warranty expense is the cost. Warranty Reserve Expense.

From carajput.com

Provision for warranty allowed/ disallowed as an expense, Warranty Exp. Warranty Reserve Expense manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. costs incurred to either repair or replace the product are additional costs of providing the initial good or service. you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. to comply with this,. Warranty Reserve Expense.

From www.slideserve.com

PPT Current Liabilities and Payroll PowerPoint Presentation, free download ID1565500 Warranty Reserve Expense warranty expense is the cost associated with a defective product repair, replacement, or refund. manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. if a seller can reasonably estimate the amount of warranty. Warranty Reserve Expense.

From www.carunway.com

Warranty Expense Journal Entry CArunway Warranty Reserve Expense you can calculate a warranty reserve liability and record it in your accounting records to reflect the amount. if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. to comply with this, companies estimate the future costs associated with warranty claims and establish a warranty. financial reporting. Warranty Reserve Expense.

From descohelp.zendesk.com

How Do I Handle Warranty Reserves in ESC Accounting? ESC Warranty Reserve Expense if a seller can reasonably estimate the amount of warranty claims likely to arise under its warranty policy, it. manufacturers need to record warranty expenses and reserves accurately to align with financial accounting principles. A warranty comes with a warranty period during which the vendor or manufacturer of the good is liable for any defects that may appear. Warranty Reserve Expense.